1. Executive Summary

The residential energy storage market in the Middle East, Africa, and Southeast Asia (MEA & SEA) is not a monolith; it is a complex matrix of diverse grid realities, economic tiers, and climatic extremes. While North American and European markets push toward the homogeneity of All-in-One (AIO) appliances, the MEA and SEA regions require a more nuanced physiological approach to product design.

This report analyzes the three dominant form factors—All-in-One (AIO), Split Components, and Rack-Mounted—as distinct strategic choices. By triangulating investment potential, supply chain logistics, regulatory hurdles, and end-user experience (UX), we conclude that while AIO systems capture the “premium” narrative in mature nodes like the UAE and Singapore, the Rack-Mounted and Split architectures currently offer superior resilience, Total Cost of Ownership (TCO), and market penetration potential across the high-growth, grid-unstable corridors of Sub-Saharan Africa and emerging Southeast Asia.

2. Strategic Landscape & Market Drivers

To understand the viability of a form factor, one must first understand the “Job to be Done” in each region.

- The Middle East (Gulf Cooperation Council – GCC): Key driver is Energy Independence & Tech-Integration. High disposable income, extreme heat, and a desire for “villa aesthetics” drive demand for high-tech, discreet solutions.

- Sub-Saharan Africa (e.g., Nigeria, South Africa): Key driver is Grid Defection/Backup. Acute instability necessitates large capacity (long-duration storage) and rugged repairability. Aesthetics are secondary to uptime.

- Southeast Asia (e.g., Vietnam, Philippines, Thailand): Key driver is Economic Optimization & Solar Self-Consumption. High electricity tariffs and rapid solar adoption drive a need for cost-effective, scalable solutions that fit into dense urban housing.

2.1 Form Factor Strategic Positioning

| Form Factor | Core Value Proposition | Strategic “Moat” | Target Market Segment |

|---|---|---|---|

| All-in-One (AIO) | “The Appliance Strategy” High aesthetic integration, plug-and-play software, minimal installer error. | Brand equity, proprietary software ecosystems, ecosystem lock-in (Apple-like). | High-Net-Worth Individuals (HNWIs) in UAE, Saudi Arabia, Singapore. New build luxury developments. |

| Split System | “The Retrofit Strategy” Separating Inverter and Battery allows flexibility in placement and sizing. | Supply chain agility, ease of compliance via separate component certification. | Mid-range urban homes in SEA (Vietnam, Thailand). Retrofitting existing solar installations. |

| Rack-Mounted | “The Utility Strategy” Maximum modularity, lowest cost per kWh, high repairability. | Standardization (19-inch server rack), open-source compatibility, massive scalability. | SME and Residential use in Nigeria, South Africa, Pakistan. Installers who want custom system design. |

3. Operational & Regulatory Reality: Barriers to Entry

A product strategy fails if it cannot be physically delivered or legally installed.

The operational landscape in MEA & SEA heavily favors component-based systems over monolithic units.

3.1 Supply Chain & Logistics: The “Landed Cost” War

Shipping completely assembled AIO units to regions with developing infrastructure poses significant risks.

- Volume & Weight: AIO units (marketing heavy aesthetics) often contain “dead air” volume and heavy casing. Shipping density is low. Rack batteries, shipped as dense, rectangular modules, achieve 30-40% higher container utilization efficiency.

- Damage Risk: A dent in the unibody chassis of a premium AIO unit renders it unsellable in a Dubai showroom. A scratch on a rack module in a Lagos warehouse is negligible.

- Localization Potential: Many African and SEA nations (e.g., Nigeria, Indonesia) have strict “Local Content” laws or high import duties on finished goods.

- Strategy: Split and Rack systems allow manufacturers to import battery cells/modules (lower tariff) and assemble the racking/casing locally. This is nearly impossible with highly integrated AIOs.

3.2 Regulatory & Grid Integration

- Certification Bottlenecks: In strict markets (UAE, South Africa), AIOs benefit from single-certification listings (IEC 62619, UL 9540). However, in rapid-growth markets, regulations change fast. If a grid code updates in Vietnam requiring a new inverter frequency parameter, an AIO manufacturer must update firmware for the whole unit. A Rack/Split system allows the installer to simply swap the inverter brand while keeping the battery, offering immense regulatory agility.

- Installer Skill Gap: AIO systems are “deskilled” installations, which is a strategic advantage in markets lacking certified engineers. However, Rack systems empower the local expert economy, creating a loyal installer base who prefers the “priesthood” of complex custom configurations.

4. User-Centric Validation: The Lived Experience

To determine the winner, we map the form factors against three distinct regional User Archetypes.

Archetype A: “The Riyadh Tech Enthusiast” (Saudi Arabia)

- Scenario: Lives in a modern villa, 45°C heat, minimal grid outages but high AC load. Wants to store cheap solar for night use.

- AIO Analysis: Winner. The user values the sleek, “refrigerator-like” aesthetic in their garage. The app interface is a status symbol. Space is not an issue.

- Climate Reality: High ambient heat is the enemy.

AIOs with active cooling (fans) are prone to dust ingress (sandstorms). Liquid-cooled AIOs are superior here but increase TCO.

- Verdict: The market supports AIO, provided the IP rating is IP65+ and the thermal management is active liquid cooling.

Archetype B: “The Lagos Business Owner” (Nigeria)

- Scenario: Home office. Grid is down 8 hours a day. Requires large capacity (20kWh+) to run ACs and servers through the night.

- Rack-Mounted Analysis:Winner.

- Scalability: The user can buy 10kWh today and slot in two more modules next month when cash flow permits. AIOs usually limit expansion or require buying a whole new expensive unit.

- Serviceability: If one module fails, the system keeps running on the remaining 15kWh. If the BMS in an AIO fails, the user is in total blackout. In Nigeria, where RMA (Return Merchandise Authorization) processes can take months, redundancy is king.

- Verdict: Rack-Mounted systems dominate due to modularity and the ability to “hot swap” components without specialized manufacturer intervention.

Archetype C: “The Metro Manila Family” (Philippines)

- Scenario: Dense urban living. High electricity rates. Space is a premium (no garage, small balcony).

- Split System Analysis:Winner.

- Spatial footprint: An AIO is too bulky for a small condo balcony. A Rack system is too industrial/ugly. A split system allows the heavy battery to be tucked under a stairwell or kitchen cabinet, while the lightweight inverter is mounted high on a wall.

- Budget: Developing market sensitivity. They need the reliability of a brand but cannot afford the “Tesla premium.” Split systems offer the best kWh-per-dollar ratio for constrained spaces.

5. Engineering & Climate Durability Assessment

The MEA/SEA regions present a “Torture Test” for battery hardware: Extreme Heat (Middle East), High Humidity/Salinity (SEA), and Fine Dust (Sahel/Middle East).

5.1 Thermal Management & Parasitic Load

- AIO Systems: Often rely on forced air cooling within a tight chassis. In 45°C ambient heat, internal temps can spike, triggering de-rating (slowing charge/discharge). The fans consume significant power (parasitic load), reducing overall efficiency.

- Split/Rack Systems:

- Advantage: Physical separation allows for better passive heat dissipation. Rack batteries often have wide spacing capabilities.

- Disadvantage: Rack systems often rely on the room’s ambient temperature. In MEA, this necessitates installing the rack in an air-conditioned room, shifting the TCO burden to the homeowner’s AC bill.

5.2 Ingress Protection (IP) & Corrosion

- SEA Humidity: In Vietnam or Indonesia, humidity averages 80%+. PCB corrosion is a major failure mode. AIO systems are generally better sealed (often potted electronics). Rack systems, often designed for server rooms, may have exposed busbars or non-conformal coated BMS boards, making them vulnerable if installed in non-climate-controlled garages.

- Strategic Implication: For Rack systems to succeed in SEA, manufacturers must upgrade enclosures from standard IP20 (indoor) to IP54 (dust/splash protected), or distributors must sell dedicated sealed cabinets.

6. Total Cost of Ownership (TCO) Modeling

We modeled a 10kWh system over a 10-year lifecycle, factoring in localized costs (Import duties, periodic maintenance, replacement availability).

| Cost Vector | All-in-One (AIO) | Split System | Rack-Mounted |

|---|---|---|---|

| Upfront Hardware CAPEX | High ($$$$) | Medium ($$$) | Low ($$) |

| Installation Labor | Low (Plug & Play) | Medium | High (Custom assembly) |

| Logistics & Duties | High (Finished goods tax) | Medium | Low (Component tariffs) |

| Maintenance (Year 5-10) | High (Proprietary parts only) | Medium | Low (Generic compatibility) |

| Expansion Cost | High (Must buy full unit) | Medium | Low (Add commodity module) |

| 10-Year TCO | Highest | Moderate | Lowest |

Critical Finding: While AIOs have lower insulation costs, the TCO advantage evaporates in MEA/SEA due to high logistics costs and the “Repair Tax.” In regions with weak supply chains, replacing a proprietary AIO board can cost 50% of the unit price. Rack systems allow generic component swapping, keeping long-term OPEX low.

7. Synthesis & Strategic Outlook

The analysis reveals a market divided not by borders, but by infrastructure maturity and economic intent.

7.1 The Winning Strategies

- For the Value/Resilience Market (Africa & Emerging SEA): The “Modular Fortress” Strategy.

- Form Factor: Rack-Mounted (enclosed in rugged cabinets).

- Why: It aligns with the shortage of dollars (low CAPEX), grid instability (high repairability needs), and local assembly incentives.

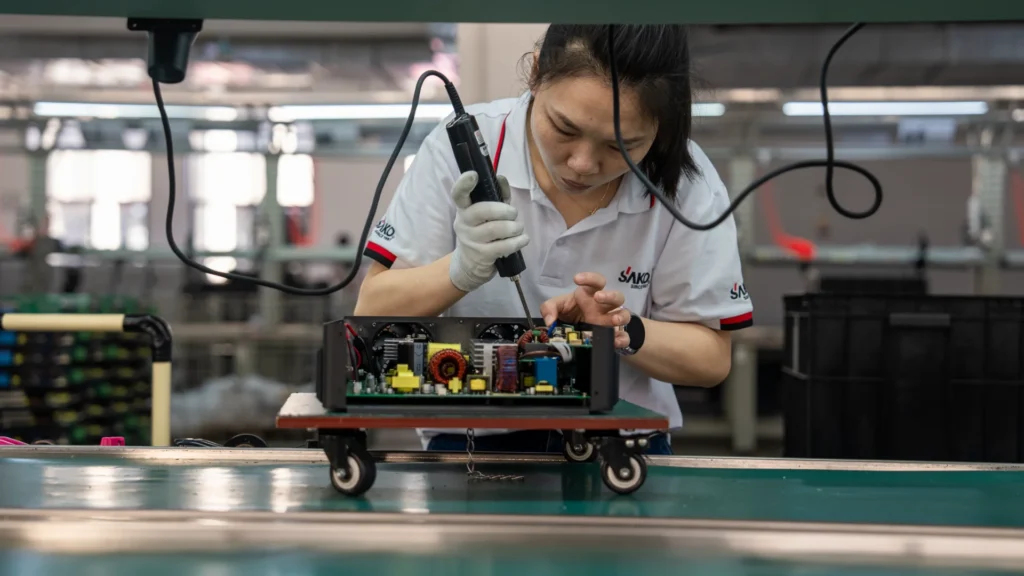

- Recommendation: Manufacturers should ship battery modules and generic inverters separately, partnering with local distributors to fabricate branded, ruggedized cabinets locally.

- For the Urban/Retrofit Market (Developed SEA): The “Flexible Integration” Strategy.

- Form Factor: Split System.

- Why: It fits physical space constraints and aligns with the heavy retrofit market where households already have solar inverters.

- Recommendation: Focus on compact, IP65-rated battery modules that can be daisy-chained.

- For the Prestige Market (Gulf & Singapore): The “Lifestyle Appliance” Strategy.

- Form Factor: All-in-One.

- Why: High willingness to pay for aesthetics and software integration.

- Recommendation: Focus on liquid cooling resilience for high heat and software ecosystems that integrate with smart home protocols (KnX, Zigbee).

7.2 Future Outlook: The “Hybrid” Form Factor

We predict a convergence toward a “Modular AIO”.

Current AIOs are too rigid; current Racks are too complex. The future market winner in MEA/SEA will be a system that looks like an AIO (sleek, single enclosure) but behaves like a Rack internally.

- Design: A recognizable consumer shell that can be opened effortlessly.

- Internals: Sliding drawers for battery modules that utilize standard connectors (not proprietary hard-wiring).

- Benefit: This captures the aesthetic premium of the Middle East while retaining the repairability and “local assembly” logistics benefits required for Africa and SEA.

8. Conclusion

In the diverse markets of MEA and SEA, imposing a Western-centric “iPhone of Batteries” (closed AIO) strategy is a high-risk gamble limited to the ultra-wealthy top 1%.

To capture the broader market share—the expanding middle class in Vietnam, the SME owner in Nigeria, the suburban family in Thailand—strategy must prioritize modularity and resilience. The Rack-Mounted architecture, when professionalized with better cabinetry and software, offers the strongest alignment with the economic and physical realities of these regions. It converts the supply chain from a liability into an asset and transforms the user experience from “passive consumer” to “resilient owner.”

Final Recommendation: Capital allocation should favor modular, component-based architectures for 80% of the TAM (Total Addressable Market) in these regions, reserving high-integration AIOs strictly for luxury niche channels.